Phasing out of restrictions on the granting of input tax refunds to large businesses

Montreal, November 22, 2017 – The Quebec Minister of Finance will be gradually phasing out the current restrictions on the granting of Input Tax Refunds (ITR) to large businesses from January 1st, 2018 to December 31, 2020. A person is generally considered a large business for QST purposes throughout a particular fiscal year if the person’s total taxable sales made through a permanent establishment in Canada, including exportations, and that of its associated persons, exceed $10,000,000 during the fiscal year preceding the person’s particular fiscal year.

The following goods and services are subject to the ITR restrictions:

- road vehicles of less than 3,000 kilograms that must be registered under the Highway Safety Code to be driven on public roads

- goods and services relating to such vehicles, where the goods or services are acquired in Québec or brought into Québec within 12 months following the date on which the vehicle was acquired in, or brought into, Québec

- fuel, other than diesel fuel, used to supply the engine of such vehicles

- electricity, gas, steam or combustibles, except when used to produce personal property intended for sale

- telephone services and other telecommunications services, except Internet access services and “1 800,” “1 888” and similar numbers

- food, beverages and entertainment that are only 50% deductible under the Taxation Act

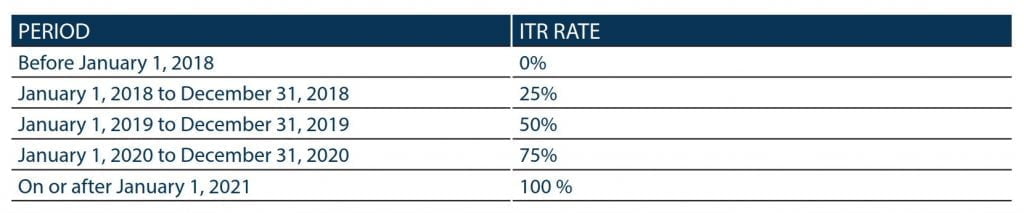

Large businesses will be entitled to ITR in the following proportions, based on the date the expense is payable:

On January 1st, 2021, these restrictions will be completely phased-out.

As a general note, a QST registrant is entitled to an ITR only to the extent the expense was incurred in the context of its commercial activities, excluding revenues exempt from QST, and where the prescribed documentation is retained.

Revenue Quebec recently issued the interpretation and administrative bulletin TVQ.206.1-10 Particulars regarding the phasing-out of the ITR restrictions applicable to large businesses that is to begin on January 1st, 2018 which provides guidance with respect to the phasing out of the ITR restrictions in specific situations (e.g. Election covering a joint venture).

The information in this release is of a general nature. For the purposes of your particular situation, you would be advised to refer to the applicable provisions of the law and, if necessary, consult a sales tax professional.

PSB Boisjoli will gladly assist you with the implications of this phase-out for your particular business.

Download the release by Lorie Palmer