Quebec Economic statement

On November 25, 2021, Quebec Finance Minister Eric Girard delivered the Update on Quebec’s Economic and Financial Situation.

The following is a summary of some of the measures announced.

COPING WITH THE COST OF LIVING

1. MITIGATING THE COST OF LIVING INCREASE

1.1 Introducing the extraordinary cost of living allowance

In its fall 2021 Update on Québec’s Economic and Financial Situation, the government is announcing the introduction of the extraordinary cost of living allowance, a single, non-reducible lump sum payment that comprises:

- an amount of $200 per adult;

- an additional amount of $75 per person living alone.

To get this benefit, a household must have received the refundable solidarity tax credit for July 2021 to June 2022.

The extraordinary allowance will be disbursed automatically to eligible households starting January 24, 2022.

1.2 Enhancing the senior assistance amount

To provide additional financial assistance for low-income seniors, the government is enhancing the senior assistance amount as of the 2021 taxation year.

The maximum annual assistance offered will rise from $209 to $400 per senior aged 70 or older starting in 2021.

Subsequent to this enhancement, seniors aged 70 or older will be able to benefit from the tax credit up to a family income of:

- $31 575 for seniors living alone;

- $54 340 for couples where both spouses are 70 years of age or older.

The refundable senior assistance tax credit remains reducible based on family income to ensure that the assistance goes solely to the low-income seniors who need it the most.

Therefore, for 2021, a single person will receive the maximum amount offered, $400, up to a family income of $23 575, while a couple in which both spouses are 70 years of age or older will receive a maximum of $800 up to a family income of $38 340.

2. SUPPORTING ACCESS TO HOUSING

2.1 Implementing the affordable housing construction assistance program

The Minister of Municipal Affairs and Housing will soon announce a new approach to encourage the creation of affordable housing in Québec.

As part of the fall 2021 Update on Québec’s Economic and Financial Situation, the government is announcing an investment of nearly $200 million to implement an affordable housing construction assistance program, which represents a new vision in the affordable housing arena.

Starting in 2022, this amount will make it possible to build approximately 2 200 affordable housing units.

The government aims to increase the supply of affordable housing on the private market in the coming years.

The pace of the program’s deployment will depend on its success.

Assistance will be provided in the form of a subsidy designed to lower construction costs for promoters.

In return for this financial assistance, promoters will have to commit, through a written agreement, to reduce rents charged to tenants in order to maintain affordable levels for a period of up to 35 years. The longer the agreement term, the higher the level of financial assistance granted.

Community and private-sector promoters will be eligible for this program, which will help them contribute more to developing the affordable housing sector.

TAKING ACTION TO COMBAT THE LABOUR SHORTAGE AND STIMULATE ECONOMIC GROWTH

1. ACCELERATING BUSINESS PRODUCTIVITY GROWTH

Making the Financial Assistance for Investment Program more flexible

The Financial Assistance for Investment Program (PAFI) supports investment projects related to converting production processes, launching or increasing production, and improving business productivity.

The assistance is provided in the form of electricity discounts.

As at November 9, 2021, 159 applications from major industrial businesses have been certified.

These applications come from 80 businesses and represent a total of more than $5.6 billion in investments.

Because of the public health crisis, businesses are facing additional delays in carrying out projects for which they have started to receive an electricity discount.

To support these businesses, and give them more time to make their investments, the government is providing the option for this 48-month electricity discount to be distributed over a maximum of 72 months.

To take advantage of this opportunity, businesses must submit an application to the Ministère des Finances, including proof of the public health crisis’s impact on the projects included in their previously certified applications under the PAFI, for which discounts are now being applied to electricity bills.

Applications must be submitted by December 31, 2022.

Given that the more flexible application period only applies to projects for which businesses are already receiving a discount on their electricity bills, and that the projects being carried out had already been included in the program’s costs, no additional financial impact is anticipated.

SUPPORTING FAMILIES

1.SUPPORTING FAMILIES

1.1 Enhancing the refundable tax credit for childcare expenses

To quickly reduce financial pressure on families facing high costs in non-subsidized childcare services, the government is enhancing the refundable tax credit for childcare expenses, beginning in the 2021 taxation year.

The enhanced tax credit is intended to ensure that parents pay a net fee that is relatively equivalent to that of a subsidized daycare, regardless of their family income.

The limit for qualifying childcare expenses for children under 7 years old is increased to $10 400 per year, beginning in 2021, which is equivalent to a daily rate of $40 for a child attending daycare full-time, or 260 days.

To provide more support for families with a disabled child, the limit that applies to disabled children will be increased to $14 230 in 2021.

The changes made to the tax credit table assure parents that the government will refund to them, through the tax credit, at least two thirds of either their qualifying childcare expenses or the limit, as applicable.

The tax assistance is enhanced by:

- adding a new tier, at a rate of 78%, for households with family incomes up to $21 000;

- increasing the rate to 70% for families with a family income between $43 880 and $101 490;

- increasing the minimum rate in the table from 26% to 67%, which is now reached at a family income of over $101 490.

1.2 Expanding access to infertility treatments

The refundable tax credit for the treatment of infertility has been changed to make it complementary to the public health coverage now offered by the Medically Assisted Procreation (“MAP”) program.

There are no longer any limits on the number of cycles eligible for the tax credit.

In addition, the cost of artificial insemination for individuals who do not qualify for the MAP program is now eligible for the tax credit, regardless of the woman’s age.

A person who does not have access to the services covered by the MAP program may receive assistance ranging from 80% to 20% of the eligible costs, based on their family income and family status, for a maximum of $20 000 in eligible expenses annually.

This tax credit represents a maximum annual assistance of $16 000 to $4 000, depending on the applicable rate.

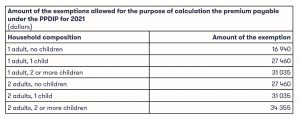

1.3 ADJUSTMENT OF THE EXEMPTIONS ALLOWED FOR THE PURPOSE OF CALCULATING THE PREMIUM PAYABLE UNDER THE PUBLIC PRESCRIPTION DRUG INSURANCE PLAN

The basic prescription drug insurance plan established by the Québec government guarantees all Quebecers fair access to the medications required by their state of health.

Adults registered with the Régie de l’assurance maladie du Québec (“RAMQ”) must make a contribution towards the payment of the cost of pharmaceutical services and drugs supplied to them whenever a prescription is filled and renewed.

Adults who are not covered throughout a year by a group insurance contract, an individual insurance contract concluded on the basis of one or more of the distinctive characteristics of group insurance or an employee benefit plan applicable to a determined group of persons must generally pay a premium for that year to finance the Public Prescription Drug Insurance Plan (“PPDIP”).

For information purposes, for the 2021 calendar year, the maximum premium payable is $686 per adult.

To reflect a household’s ability to pay, the annual premium payable by an adult is determined on the basis of family income, from which an exemption amount based on the household’s composition is subtracted.

The amount of these exemptions has been adjusted annually to protect household purchasing power.

The government will adjust, for 2021, the amount of each of the exemptions currently allowed.

The following table shows the amount of each of the allowable exemptions for 2021, according to household composition.