A supplier/owner of rental properties who is registered for the GST/HST/QST and who provides taxable rentals via an accommodation platform, such as Airbnb, is required to remit to Revenu Quebec the GST/HST/QST collected from the rentals. The platform may collect the GST/HST/QST from the renter but must transfer the collected amounts to the supplier/owner, who subsequently remits them to Revenu Quebec.

In practice, however, compliance with these new rules is poor. For example, we observed that the widely-used platform Airbnb frequently remits the GST/HST/QST directly to Revenu Quebec even when the supplier/owner is registered for GST/HST/QST and provided Airbnb with his/her GST/HST/QST account numbers.

Suppliers/owners of rental properties who are not in compliance with the law are at risk of being assessed by Revenu Quebec for taxes that have been collected but not remitted even if these taxes were remitted to Revenu Quebec by Airbnb.

It is therefore imperative that all suppliers/owners of rental properties who are registered for the GST/HST/QST configure their profile on Airbnb to ensure that they receive the taxes collected by Airbnb on rentals instead of Airbnb directly remitting the taxes to Revenu Quebec.

Unfortunately, the Airbnb platform is not user-friendly and it is not obvious where to enter tax information to ensure proper profile set-up. We prepared this communication to assist our clients and business partners in complying with the law and avoid disputes in future tax audit. This communication illustrates the steps required for the supplier/owner to correctly configure his/her tax profile on Airbnb. Detailed instructions can be found in Sections 1 and 2 on the following pages.

Note that in situations where the supplier/owner is not registered for GST/HST/QST, Airbnb is required to remit the GST/HST/QST collected from the renters.

An agreement concluded in 2017 between Airbnb and Revenu Quebec allows Airbnb, with some exceptions, to collect and remit the Tax on lodging directly to Revenu Quebec on behalf of all suppliers/owners, regardless of whether or not they are registered for this tax.

SECTION 1: ADDING GST/HST/QST REGISTRATION NUMBERS TO THE SUPPLIER/OWNER’S PROFILE ON THE AIRBNB WEBSITE

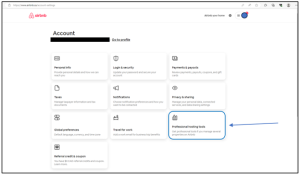

Step 1: Go to the “account” section of your profile

Step 2: Click on “Taxes”

Step 3: Click on “Add tax info”

Step 4: Enter the requested information (Taxpayer info, GST ID, QST ID, HST ID). Please note that “HST ID” is the same number As “GST ID”

SECTION 2: CONFIGURING THE SUPPLIER/OWNER’S AIRBNB PROFILE TO ENSURE THAT THE TAXES COLLECTED BY AIRBNB ARE REMITTED TO THE SUPPLIER/OWNER INSTEAD OF REVENU QUEBEC

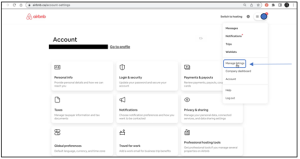

Step 1: Still in the “Account” section of your profile, click on “Professional hosting tools”

Step 2: click on “Manage” and then “Use professional tools”

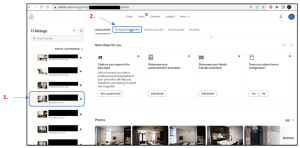

Step 3: Return to your profile and select “Manage listings”

Step 4: Click on “Menu” and then “Listings”

Step 5: Select the listing for which you want to add tax information and then click on “Pricing and availability”

Step 6: Go to the “Taxes” section and click “edit”

Step 7: click “Add a tax”

Step 8: for GST/HST:

- Select VAT/GST

- Tick all the boxes in “Taxable base” whether or not these charges are invoiced

- Add your GST/HST number in the box “Business tax ID”

- Add your tax on lodging number in the box “Accommodation tax registration number”. if you do not have this number, please write “N/A”

- Please consult your tax advisor to determine what to include in the section “Long term stays” outlined in red. Your tax obligations will vary depending on the type of building and rental you provide.

Step 9: For QST:

- Select Sales tax

- Tick all the boxes in “Taxable base” whether or not these charges are invoiced

- Add your QST number in the box “Business tax ID”

- Add your tax on lodging number in the box “Accommodation tax registration number”. if you do not have this number, please write “N/A”

- Please consult your tax advisor to determine what to include in the section “Long term stays” outlined in red. Your tax obligations will vary depending on the type of building and rental you provide.

Step 10: Once finished, confirm that the items “VAT/GST” and “Sales tax” (outlined in blue) appear on the reservation page of the listing to validate that the previous steps were completed.

IMPORTANT: Please note that you will have to complete all the steps in section 2 for each rental unit that you list on Airbnb.

The information contained in this communication is of a general nature. The rules governing the application of GST/HST/QST to rental properties can be complex. For questions regarding your specific situation, you are advised to consult the relevant articles of law or consult with an indirect tax professional.