As Quebec is likely heading into a full lockdown for the upcoming weeks, the following is a brief summary of how the Canada Emergency Wage Subsidy (“CEWS”) is expected to work during the expected lockdown period.

The CEWS measures are divided into periods. CEWS period 11 runs from December 20, to January 16. The lockdown will likely also impact CEWS period 12, which runs from January 17 to February 13.

Support for active employees

If the employees remain active and the revenue drop in the period is more than 50%, the base CEWS of 40% would be available plus a top up CEWS, which maxes out at 35% (i.e. the maximum an employer can receive is 75% of wages paid out). The top up CEWS is calculated based on the following formula: 1.75 x (revenue decline – 50%). The maximum amount of CEWS that can be received by an employer is expected to be $847 per employee per week.

If the employee remains active and the revenue drop is less than 50%, then the CEWS percentage that is used would be 0.8 x revenue drop.

Support for furloughed employees

If the employees are furloughed (i.e. the employee is remunerated but does not perform work in the week), the employer would receive the lessor of:

- The remuneration paid; or

- The greater of:

- 55% of the baseline remuneration (up to $595), and

- $500.

For furloughed employees, the CEWS is also calculated on a weekly basis.

Employers will also continue to be entitled to claim under the wage subsidy their portion of contributions in respect of the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan in respect of furloughed employees.

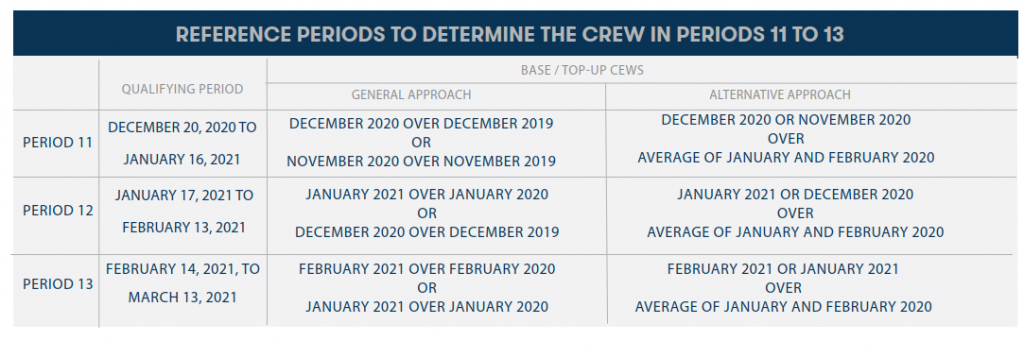

Reference periods

The reference periods are in the following table. The employer can choose the reference period approach. However, employers that have chosen to use the general approach for prior periods would continue to use that approach. Similarly, employers that have chosen to use the alternative approach would continue to use the alternative approach.

EMPLOYMENT INSURANCE BENEFITS AND CANADA RECOVERY BENEFIT PROGRAM

Employment Insurance claimants (“EI”) claimants will receive a one-time hours credit, allowing claimants to work only 120 hours in order to qualify for benefits. This credit is retroactive to March 15, 2020, and available until September 27, 2021.

New EI claimants as of September 27, 2020, will receive a minimum benefit rate of $500 per week before tax (or $300 per week for extended parental benefits) if this amount is higher than the amount they would otherwise receive.

The Canada Recovery Benefit provides a benefit amount of $500 per week for up to 26 weeks to workers who are not eligible for EI. This benefit specifically targets the self-employed.

To qualify, an individual must be resident in Canada and meet the following the eligibility requirements:

- be at least 15 years old and have a Social Insurance Number (SIN);

- had employment or self-employment income of at least $5,000 in 2019 or 2020.

- have stopped working due to COVID-19 and are looking for work or have had a reduction in the income due to COVID-19;

- are not eligible for EI; and

- have not quit their job voluntarily.

ASSISTANCE FOR BUSINESSES IN REGIONS UNDER MAXIMUM ALERT

Finally, the Quebec’s ministère de l’Économie et de l’Innovation has created a special stream for businesses that must partially or completely cease operations because they are located in a maximum alert zone. The Assistance for Businesses in Regions Under Maximum Alert (“ABRUMA”) consists of a non-repayable loan (loan forgiveness) covering up to 100% of eligible core operating costs to a maximum of $15,000 per month of closure up to a maximum of 80% of the total of the loan. The ABRUMA is granted as part of:

- the Emergency Assistance for Small and Medium-Sized Businesses for loans of up to $50,000, or

- the Temporary Action Program for Businesses for loan greater of $50,000.