Introduction

On March 28, 2023, Deputy Prime Minister and Minister of Finance, Chrystia Freeland, presented Budget 2023: A plan to build a stronger, more sustainable, and more secure economy for everyone.

The budget proposes new measures to:

- facilitate intergenerational business transfers

- facilitate the use of Employee Ownership Trusts an additional option for succession planning

- strengthen the General Anti-Avoidance Rule

- better target the Alternative Minimum Tax for High-Income Individuals

- invest in building Canada’s clean economy

- making life more affordable

- make dental care affordable for Canadians

The budget also proposes a responsible fiscal plan that will see Canada maintain the lowest deficit and the lowest net debt-to-GDP ratio in the G7.

Here are the highlights of the 2023 budget.

Measures pertaining to individuals

Grocery Rebate

Budget 2023 proposes to introduce an increase to the maximum GSTC amount for January 2023 that would be known as the Grocery Rebate. The Grocery Rebate would be paid as soon as possible following the passage of legislation, through the GSTC system. The maximum amount would be:

- $153 per adult;

- $81 per child; and

- $81 for the single supplement.

Employee Ownership Trusts

Budget 2023 proposes new rules to facilitate the use of Employee Ownership Trusts (EOT) to acquire and hold shares of a business.

The government welcomes stakeholder feedback on how best to enhance employee rights and participation in the governance of EOT.

Definitions

A trust would be considered an EOT if it is a Canadian resident trust (excluding deemed resident trusts) and has only two purposes. First, it would hold shares of qualifying businesses for the benefit of the employee beneficiaries of the trust. Second, it would make distributions to employee beneficiaries, where reasonable, under a distribution formula that could only consider an employee’s length of service, remuneration, and hours worked. Otherwise, all beneficiaries must generally be treated in a similar manner.

An EOT would be required to hold a controlling interest in the shares of one or more qualifying businesses. All or substantially all of an EOT’s assets must be shares of qualifying businesses. A qualifying business would need to meet certain conditions, including that all or substantially all of the fair market value of its assets are attributable to assets used in an active business carried on in Canada. An EOT would not be permitted to allocate shares of qualifying businesses to individual beneficiaries. A qualifying business must not carry on its business as a partner to a partnership.

Governance

When an existing business is sold to an EOT, individuals and their related persons who held a significant economic interest in the existing business prior to the sale would not be able to account for more than 40 per cent of:

- the trustees of the EOT;

- directors of the board of a corporation serving as a trustee of the EOT; or

- directors of any qualifying business of the EOT.

Trust Beneficiaries

Beneficiaries of the trust must consist exclusively of qualifying employees. Qualifying employees would include all individuals employed by a qualifying business and any other qualifying businesses it controls, with the exclusion of employees who are significant economic interest holders, or have not completed a reasonable probationary period of up to 12 months.

Individuals and their related persons who hold, or held prior to the sale to an EOT, a significant economic interest in a qualifying business of the EOT would also be excluded from being qualifying employees.

Tax Treatment

The EOT would generally be subject to the same rules as other personal trusts. Undistributed trust income would be taxed in the EOT at the top personal marginal tax rate, whereas trust income distributed from an EOT to its beneficiaries would not be subject to tax at the trust level but at the beneficiary level. If the EOT distributes dividends received from qualifying businesses, those dividends would retain their character when received by employee beneficiaries and would therefore be eligible for the dividend tax credit.

Qualifying Business Transfer

The shares of a qualifying business must be disposed for no more than fair market value to either a trust that qualifies as an EOT immediately after the sale or a corporation wholly-owned by the EOT.

Modifications of certain Tax Rules

Budget 2023 would extend the capital gains reserve from five to ten years for qualifying sales to an EOT, creating an exception to the current shareholder loan rule, to extend the repayment period from one to 15 years for amounts loaned to the EOT, and exempt them from the 21-year deemed disposition rule that applies to certain trusts.

Coming into Force

These amendments would apply as of January 1, 2024.

Deduction for Tradespeople’s Tool Expenses

Budget 2023 proposes to double the maximum employment deduction for tradespeople’s tools from $500 to $1,000, effective for 2023 and subsequent taxation years.

Registered Education Savings Plans

Increasing Educational Assistance Payment withdrawal limits

Budget 2023 proposes to increase limits on Registered Education Savings Plans (RESP) Educational Assistance Payment (EAP) withdrawals from $5,000 to $8,000 for full-time students, and from $2,500 to $4,000 for part-time students.

These changes would come into force on March 28, 2023. Individuals who withdrew EAPs prior to March 28, 2023 may be able to withdraw an additional EAP amount, subject to the new limits and the terms of the plan.

Allowing divorced or separated parents to open joint RESPs

Budget 2023 proposes to enable divorced or separated parents to open joint RESPs for one or more of their children, or to move an existing joint RESP to another promoter.

This change would come into force on March 28, 2023.

Retirement Compensation Arrangements

Under the Income Tax Act, a retirement compensation arrangement (RCA) is a type of employer-sponsored arrangement that generally allows an employer to provide supplemental pension benefits to employees.

Employers can choose to pre-fund supplemental retirement benefits through contributions to a trust established under an RCA (RCA trust). Under Part XI.3 of the Income Tax Act, a refundable tax is imposed at a rate of 50 per cent on contributions to an RCA trust, as well as on income and gains earned or realized by the trust. The tax is generally refunded as the retirement benefits are paid from the RCA trust to the employee.

Budget 2023 proposes that fees or premiums paid for the purposes of securing or renewing a letter of credit (or a surety bond) for an RCA that is supplemental to a registered pension plan will not be subject to the refundable tax.

This change would apply to fees or premiums paid on or after March 28, 2023.

Budget 2023 also proposes to allow employers to request a refund of previously remitted refundable taxes in respect of fees or premiums paid for letters of credit (or surety bonds) by RCA trusts, based on the retirement benefits that are paid out of the employer’s corporate revenues to employees that had RCA benefits secured by letters of credit (or surety bonds). Employers would be eligible for a refund of 50 per cent of the retirement benefits paid, up to the amount of refundable tax previously paid.

This change would apply to retirement benefits paid after 2023.

Registered Disability Savings Plans

Qualifying Family Members

A temporary measure allows a qualifying family member, who is a parent, spouse or common-law partner, to open an RDSP and be the plan holder for an adult whose capacity to enter into an RDSP contract is in doubt, and who does not have a legal representative.

Budget 2023 proposes to extend the qualifying family member measure by three years, to December 31, 2026. A qualifying family member who becomes a plan holder before the end of 2026 could remain the plan holder after 2026.

Siblings as Qualifying Family Members

Budget 2023 also proposes to broaden the definition of ‘qualifying family member’ to include a brother or sister of the beneficiary who is 18 years of age or older.

This proposed expansion of the existing qualifying family member definition would apply as of royal assent and be in effect until December 31, 2026. A sibling who becomes a qualifying family member and plan holder before the end of 2026 could remain the plan holder after 2026.

Alternative Minimum Tax for High-Income Individuals

To better target the Alternative Minimum Tax (AMT) to high-income individuals, Budget 2023 proposes several changes to its calculation:

- broaden the AMT base by further limiting tax preferences, for example:

- 100% capital gains inclusion (previously at 80%);

- 30% capital gains inclusion on donations of publicly listed securities (previously not included);

- 100% inclusion associated with employee stock options pursuant to 110(1)(d) or 110(1)(d.1) of the Income Tax Act (previously at 80%);

- 50% deduction of capital loss carryforwards (previously at 80%);

- 50% deduction of allowable business investment losses (previously at 80%);

- 50% deduction of non-capital loss carryovers (previously at 100%);

- 50% deduction for limited partnership losses of other years (previously at 100%).

- increase the AMT exemption from $40,000 to the start of the fourth federal tax bracket. Based on expected indexation for the 2024 taxation year, this would be approximately $173,000. The exemption amount would be indexed annually to inflation; and

- increase the AMT rate from 15 per cent to 20.5 per cent, corresponding to the rates applicable to the first and second federal income tax brackets, respectively.

The length of the carry forward would be maintained at seven years.

Trusts that are currently exempt from the AMT would continue to be exempt.

Additional details will be released later this year.

Coming into Force

The proposed changes would come into force for taxation years that begin after 2023.

Strengthening the Intergenerational Business Transfer Framework

Budget 2023 proposes to amend the rules introduced by Bill C-208 to ensure that they apply only where a genuine intergenerational business transfer takes place.

A genuine intergenerational share transfer would be a transfer of shares of a corporation (the Transferred Corporation) by a natural person (the Transferor) to another corporation (the Purchaser Corporation) where a number of conditions are satisfied. The following existing conditions would be maintained:

- each share of the Transferred Corporation must be a “qualified small business corporation share” or a “share of the capital stock of a family farm or fishing corporation”, at the time of the transfer; and

- the Purchaser Corporation must be controlled by one or more persons each of whom is an adult child of the Transferor (the meaning of “child” for these purposes would include grandchildren, step-children, children-in-law, nieces and nephews, and grandnieces and grandnephews).

It is proposed that taxpayers who wish to undertake a genuine intergenerational share transfer may choose to rely on one of two transfer options:

- an immediate intergenerational business transfer (three-year test) based on arm’s length sale terms; or

- a gradual intergenerational business transfer (five-to-ten-year test) based on traditional estate freeze characteristics.

The table in the appendix outlines the proposed conditions to qualify as a genuine intergenerational business transfer under both options.

The rules introduced by Bill C-208 that apply to subsequent share transfers by the Purchaser Corporation and the lifetime capital gains exemption are proposed to be replaced by relieving rules that would apply upon a subsequent arm’s length share transfer or upon the death or disability of a child. There would be no limit on the value of shares transferred in reliance upon this rule.

The Transferor and child (or children) would be required to jointly elect for the transfer to qualify as either an immediate or gradual intergenerational share transfer. The child (or children) would be jointly and severally liable for any additional taxes payable by the Transferor, because of section 84.1 applying, in respect of a transfer that does not meet the above conditions. The joint election and joint and several liability recognize that the actions of the child could potentially cause the parent to fail the conditions and to be reassessed under section 84.1. This election should be filed on or before the Transferor’s filing-due date for the taxation year that includes the disposition time.

Extension of the limitation period

The limitation period for reassessing the Transferor’s liability for tax that may arise on the transfer is proposed to be extended:

- By 3 years for an immediate business transfer

- By ten years for a gradual business transfer.

Capital Gains Reserve

Budget 2023 also proposes to provide a ten-year capital gains reserve for genuine intergenerational share transfers that satisfy the above proposed conditions.

Coming into Force

These measures would apply to transactions that occur on or after January 1, 2024.

Measures pertaining to businesses

Investment Tax Credit for Clean Hydrogen

Budget 2023 proposes to introduce the Clean Hydrogen Investment Tax Credit (CH Tax Credit) with the following key design features:

- The levels of support will vary between 15 and 40 per cent of eligible project costs, with the projects that produce the cleanest hydrogen receiving the highest levels of support;

- The CH Tax Credit would be refundable. It could be claimed when eligible equipment becomes available for use;

- The CH Tax Credit will also extend a 15 per cent tax credit to equipment needed to convert hydrogen into ammonia, in order to transport the hydrogen. The tax credit will only be available to the extent the ammonia production is associated with the production of clean hydrogen; and,

- Labour requirements will need to be met to receive the maximum tax credit rates. If labour requirements are not met, credit rates will be reduced by ten percentage points. These labour requirements will come into effect on October 1, 2023.

Coming into Force

This measure would apply to property that is acquired and that becomes available for use on or after March 28, 2023. The CH Tax Credit would be phased out starting in 2034, with property that becomes available for use in 2034 subject to a credit rate that is reduced by one half. The CH Tax Credit would be fully phased out for property that becomes available for use after 2034.

Investment Tax Credit for Clean Technology Manufacturing

Budget 2023 proposes to introduce a refundable investment tax credit for clean technology manufacturing and processing, and critical mineral extraction and processing, equal to 30 per cent of the capital cost of eligible property associated with eligible activities.

Eligible Property

Investments by corporations in certain depreciable property that is used all or substantially all for eligible activities would qualify for the credit. Eligible property would generally include machinery and equipment, including certain industrial vehicles, used in manufacturing, processing, or critical mineral extraction, as well as related control systems.

Eligible Activities

Eligible activities related to clean technology manufacturing and processing would include:

- Extraction, processing, or recycling of critical minerals essential for clean technology supply chains, specifically: lithium, cobalt, nickel, graphite, copper, and rare earth elements;

- Manufacturing of renewable or nuclear energy equipment;

- Processing or recycling of nuclear fuels and heavy water;

- Manufacturing of grid-scale electrical energy storage equipment;

- Manufacturing of zero-emission vehicles; and,

- Manufacturing or processing of certain upstream components and materials for the above activities, such as cathode materials and batteries used in electric vehicles.

Application and Phase-Out

The Investment Tax Credit for Clean Technology Manufacturing would apply to property that is acquired and becomes available for use on or after January 1, 2024.

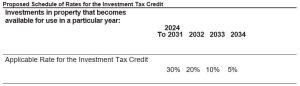

The Investment Tax Credit for Clean Technology Manufacturing would be gradually phased out starting with property that becomes available for use in 2032 and would no longer be in effect for property that becomes available for use after 2034 (as shown in the table below).

Proposed Schedule of Rates for the Investment Tax Credit

Clean Technology Investment Tax Credit – Geothermal Energy

Budget 2023 proposes to expand eligibility of the Clean Technology Investment Tax Credit to include geothermal energy systems that are eligible for Class 43.1 of Schedule II of the Income Tax Regulations.

Eligible property would include equipment used primarily for the purpose of generating electrical energy or heat energy, or both electrical and heat energy, solely from geothermal energy.

Equipment used for geothermal energy projects that will co-produce oil, gas or other fossil fuels would not be eligible for the credit.

The expansion of the Clean Technology Investment Tax Credit would apply in respect of property that is acquired and becomes available for use on or after March 28, 2023, where it has not been used for any purpose before its acquisition.

Phase-Out

The credit rate would remain at 30 per cent for property that becomes available for use in 2032 and 2033 and would be reduced to 15 per cent in 2034. The credit would be unavailable after 2034.

Labour Requirements Related to Certain Investment Tax Credits

Budget 2023 is announcing additional details on the labour requirements for the Clean Technology and Clean Hydrogen Investment Tax Credits.

- To be eligible for the highest tax credit rates, businesses must pay a total compensation package that equates to the prevailing wage. The definition of prevailing wage would be based on union compensation, including benefits and pension contributions from the most recent, widely applicable multi-employer collective bargaining agreement, or corresponding project labour agreements, in the jurisdiction within which relevant labour is employed.

- Additionally, at least ten per cent of the tradesperson hours worked must be performed by registered apprentices in the Red Seal trades.

The government also intends to apply labour requirements related to the prevailing wage and hours worked by registered apprentices to the Investment Tax Credit for Carbon Capture, Utilization, and Storage, and the Investment Tax Credit for Clean Electricity. Further details will be provided at a later date.

In all cases, the requirements would apply to labour that is performed on or after October 1, 2023.

Zero-Emission Technology Manufacturers

Expansion of Eligible Activities

Budget 2023 proposes that income from the following nuclear manufacturing and processing activities would qualify for the reduced tax rates for zero-emission technology manufacturers:

- manufacturing of nuclear energy equipment;

- processing or recycling of nuclear fuels and heavy water; and

- manufacturing of nuclear fuel rods.

This expansion of eligible activities would apply for taxation years beginning after 2023.

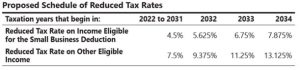

Extension of the Reduced Tax Rates

Budget 2023 proposes to extend the availability of the reduced tax rates for zero-emission technology manufacturers by three years, such that the planned phase-out would start in taxation years that begin in 2032 (as shown in the table below). The measure would be fully phased out for taxation years that begin after 2034.

Investment Tax Credit for Carbon Capture, Utilization, and Storage

Budget 2023 proposes that the Investment Tax Credit for Carbon Capture, Utilization, and Storage (CCUS):

- Include dual use heat and/or power equipment and water use equipment, with tax support prorated in proportion to the use of energy or material in the carbon capture, utilization, and storage process, subject to certain conditions;

- In addition to Saskatchewan and Alberta, be available to projects that would store CO2 using dedicated geological storage in British Columbia;

- Require projects storing CO2 in concrete to have their concrete storage process validated by a third-party based on an ISO standard prior to claiming the investment tax credit; and,

- Include a recovery calculation for the investment tax credit in respect of refurbishment property.

The government intends to apply labour requirements to the Investment Tax Credit for CCUS. Details will be announced at a later date. These labour requirements will come into effect on October 1, 2023.

A full package of legislative proposals will be released for consultation in the coming months. Once legislated, the tax credit will be retroactively available to businesses that have incurred eligible CCUS expenses, starting in 2022 and before 2041.

An Investment Tax Credit for Clean Electricity

Budget 2023 proposes to introduce a 15 per cent refundable tax credit for eligible investments in:

- Non-emitting electricity generation systems: wind, concentrated solar, solar photovoltaic, hydro (including large-scale), wave, tidal, nuclear (including large-scale and small modular reactors);

- Abated natural gas-fired electricity generation (which would be subject to an emissions intensity threshold compatible with a net-zero grid by 2035);

- Stationary electricity storage systems that do not use fossil fuels in operation, such as batteries, pumped hydroelectric storage, and compressed air storage; and,

- Equipment for the transmission of electricity between provinces and territories.

Both new projects and the refurbishment of existing facilities will be eligible.

Taxable and non-taxable entities would be eligible for the Clean Electricity Investment Tax Credit.

The Clean Electricity Investment Tax Credit could be claimed in addition to the Atlantic Investment Tax Credit, but generally not with any other investment tax credit.

The Clean Electricity Investment Tax Credit would be available as of the day of Budget 2024 for projects that did not begin construction before March 28, 2023. The Clean Electricity Investment Tax Credit would not be available after 2034.

Labour requirements, including ensuring that wages paid are at the prevailing level, and that apprenticeship training opportunities are being created, will need to be met to receive the full 15-per-cent tax credit. If labour requirements are not met, the credit rate will be reduced by ten percentage points. These labour requirements will come into effect on October 1, 2023.

In order to access the tax credit in each province and territory, other requirements will be included.

Tax on Repurchases of Equity

Budget 2023 announces that the proposed 2% tax would apply as of January 1, 2024 to the annual net value of repurchases of equity by public corporations and certain publicly traded trusts and partnerships in Canada. A business would not be subject to the tax in a year if its gross repurchases of equity were less than $1 million.

General Anti-Avoidance Rule

Budget 2023 proposes to amend the general anti-avoidance rule (GAAR) as follows:

- A preamble would be added to the GAAR, in order to help address interpretive issues and ensure that the GAAR applies as intended regardless of whether or not the tax planning strategy used to obtain the tax benefit was foreseen.

- The threshold for the avoidance transaction test in the GAAR would be reduced from a “primary purpose” test to a “one of the main purposes” test.

- A rule would be added to the GAAR so that it better meets its initial objective of requiring economic substance. This rule requires consideration of a lack of economic substance in the determination of abusive tax avoidance.

- A penalty would be introduced for transactions subject to the GAAR, equal to 25 per cent of the amount of the tax benefit. The penalty could be avoided if the transaction is disclosed to the Canada Revenue Agency, either as part of the proposed mandatory disclosure rules or voluntarily.

- A three-year extension to the normal reassessment period would be provided for GAAR assessments, unless the transaction had been disclosed to the Canada Revenue Agency.

Consultation

The government is interested in stakeholders’ views on these proposals and interested parties are invited to send written representations to the Department of Finance Canada by May 31, 2023.

Measures pertaining to commodity taxes

GST/HST Treatment of Payment Card Clearing Services

Budget 2023 proposes to amend the GST/HST definition of “financial service” to clarify that payment card clearing services rendered by a payment card network operator are excluded from the definition to ensure that such services generally continue to be subject to the GST/HST.

This measure would apply to a service rendered under an agreement for a supply if any consideration for the supply becomes due, or is paid without becoming due, after March 28, 2023. This measure would also apply to a service rendered under an agreement for a supply if all of the consideration for the supply became due, or was paid, on or before March 28, 2023, except in certain situations.

Alcohol Excise Duty

Budget 2023 proposes to temporarily cap the inflation adjustment for excise duties on beer, spirits and wine at two per cent, for one year only, as of April 1, 2023.

Cannabis Taxation – Quarterly Duty Remittances

Budget 2023 proposes to allow all licensed cannabis producers to remit excise duties on a quarterly rather than monthly basis, starting from the quarter beginning on April 1, 2023.

Air Travellers Security Charge

Budget 2023 proposes to increase the Air Travellers Security charge (ATSC) rates by 32.85 per cent.

The proposed new ATSC rates will apply to air transportation services that include a chargeable emplanement on or after May 1, 2024, for which any payment is made on or after that date.

Measures pertaining to international tax

International Tax Reform

Canada continues to support the two-pillar international tax reform plan on Base Erosion and Profit Shifting.

Pillar One (Reallocation of Taxing Rights)

Pillar One will ensure that the largest and most profitable global corporations, including large digital corporations, pay their fair share of tax in the jurisdictions where their users and customers are located. Canada and our international partners have been developing the rules of this innovative new system through an OECD-led process, and countries are working towards completing multilateral negotiations so that the treaty to implement Pillar One can be signed by mid-2023.

To ensure that Canadians’ interests are protected in any circumstance, the federal government will continue to advance legislation for a Digital Services Tax.

Pillar Two (Global Minimum Tax)

Pillar Two, a global minimum tax regime, will ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business.

Budget 2023 reaffirms Canada’s intention, announced in Budget 2022, to introduce legislation implementing the Pillar Two global minimum tax. The primary charging rule of Pillar Two and a domestic minimum top-up tax would be effective for fiscal years of multinational corporations that begin on or after December 31, 2023. The secondary charging rule would be effective for fiscal years that begin on or after December 31, 2024. The government will continue to monitor international developments as it moves forward with the implementation of Pillar Two.

Other measures

Canadian Dental Care Plan

The plan will provide dental coverage for uninsured Canadians with annual family income of less than $90,000, with no co-pays for those with family incomes under $70,000.

Details on eligible coverage will be released later this year.

Seasonal EI Claimants

Eligible seasonal workers in 13 economic regions receive up to a maximum of five additional weeks, for a maximum of 45 weeks.

Budget 2023 proposes to extend this support for seasonal workers until October 2024.

Scientific Research and Experimental Development Tax Incentive Program

In Budget 2022, the federal government announced its intention to review the SR&ED program to ensure it is providing adequate support and improving the development, retention, and commercialization of intellectual property, including the consideration of adopting a patent box regime. The Department of Finance will continue to engage with stakeholders on the next steps in the coming months.

Previously announced measures

Budget 2023 confirms the government’s intention to proceed with the following previously announced tax and related measures, as modified to take into account consultations and deliberations since their release.

- Legislative proposals released on November 3, 2022 with respect to Excessive Interest and Financing Expenses Limitations and Reporting Rules for Digital Platform Operators.

- Tax measures announced in the Fall Economic Statement on November 3, 2022, for which legislative proposals have not yet been released, including:

- Automatic Advance for the Canada Workers Benefit;

- Investment Tax Credit for Clean Technologies; and

- Extension of the Residential Property Flipping Rule to Assignment Sales.

- Legislative proposals released on August 9, 2022, including with respect to the following measures:

- Borrowing by Defined Benefit Pension Plans;

- Reporting Requirements for Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs);

- Fixing Contribution Errors in Defined Contribution Pension Plans;

- The Investment Tax Credit for Carbon Capture, Utilization and Storage;

- Substantive Canadian-Controlled Private Corporations;

- Mandatory Disclosure Rules;

- The Electronic Filing and Certification of Tax and Information Returns; and

- other technical amendments to the Income Tax Act and Income Tax Regulations proposed in the August 9th release;

- Legislative proposals released on April 29, 2022 with respect to Hybrid Mismatch Arrangements.

- Legislative proposals released on February 4, 2022 with respect to the Goods and Services Tax/Harmonized Sales Tax treatment of Cryptoasset Mining.

- Legislative proposals tabled in a Notice of Ways and Means Motion on December 14, 2021 to introduce the Digital Services Tax Act.

- The transfer pricing consultation announced in Budget 2021.

- Measures confirmed in Budget 2016 relating to the Goods and Services Tax/Harmonized Sales Tax joint venture election.

Budget 2023 also reaffirms the government’s commitment to move forward as required with other technical amendments to improve the certainty and integrity of the tax system.

Appendix

| Proposed Conditions | Immediate Business Transfer (three-year test) | Gradual Business Transfer (five to ten-year test) |

| 1) Transfer of Control of the Business | Parents immediately and permanently transfer both legal and factual* control, including an immediate transfer of a majority of voting shares, and a transfer of the balance of voting shares within 36 months

*Factual control means economic and other influence that allows for effective control of a corporation (for example, economic dependence on a person who also acts as the controlling mind) |

Parents immediately and permanently transfer only legal** control, including an immediate transfer of a majority of voting shares (no transfer of factual control), and a transfer of the balance of voting shares within 36 months

**Legal control generally means the right to elect a majority of the directors of a corporation |

| 2) Transfer of Economic Interests in the Business | Parents immediately transfer a majority of the common growth shares, and transfer the balance of common growth shares within 36 months

(It is expected that the transfers of legal and factual control as well as future growth of the business are sufficient to ensure the parents have transferred a substantial economic interest in the business to their child(ren).) |

Parents immediately transfer a majority of the common growth shares, and transfer the balance of common growth shares within 36 months In addition, within 10 years of the initial sale, parents reduce the economic value of their debt and equity interests in the business to: (a) 50% of the value of their interest in a farm or fishing corporation at the initial sale time, or (b) 30% of the value of their interest in a small business corporation at the initial sale time |

| 3) Transfer of Management of the Business | Parents transfer management of the business to their child within a reasonable time based on the particular circumstances (with a 36-month safe harbour) | Parents transfer management of the business to their children within a reasonable time based on the particular circumstances (with a 36-month safe harbour) |

| 4) Child Retains Control of the Business | Child(ren) retains legal (not factual) control for a 36-month period following the share transfer | Child(ren) retains legal (not factual) control for the greater of 60 months or until the business transfer is completed |

| 5) Child Works in the Business | At least one child remains actively involved in the business for the 36-month period following the share transfer | At least one child remains actively involved in the business for the greater of 60 months or until the business transfer is completed |

Notice to Users

The reproduction of the contents of this federal budget summary is authorized without restriction.

This budget summary is based on the documents issued by the federal government. The legislation, when enacted, may vary from the summary described herein. Professional advice should be obtained.

PSB Boisjoli LLP has acted solely as publisher of this budget summary. Consequently, neither PSB BOISJOLI LLP nor any person involved in its preparation accepts any liability for its contents or for any consequences arising from its use.