Introduction

The Minister of Finance, Mr. Eric Girard, tabled his 2023-2024 budget plan on March 21, 2023, which aims to stimulate the labour supply and reduce the tax burden of Quebecers, in particular by decreasing the two bottom tax rates for personal tax.

Other initiatives are planned to increase the economy’s productivity, contribute to the prosperity of the regions and address the labour shortage. Changes are also being made to the Québec Pension Plan to adapt it to the new realities of workers and retired people.

Here are the highlights of the 2023-2024 budget.

Measures pertaining to individuals

General reduction in personal income tax as of the 2023 taxation year

The tax legislation will be amended so that, as of the 2023 taxation year:

- on the one hand, the tax rate for the first taxable income bracket, which does not exceed $49 275 for the 2023 taxation year, will be reduced by one percentage point, from 15% to 14%;

- on the other hand, the tax rate for the second taxable income bracket, which is the bracket over $49 275, but not exceeding $98 540, will also be reduced by one percentage point, from 20% to 19%.

Moreover, individuals who are required to pay their income tax in instalments may adjust, in accordance with the usual rules, any instalment payment due after March 15, 2023, in order to take into account the general tax reduction applicable for the 2023 taxation year.

Changes to personal tax credits

Decrease in the conversion rate

The tax legislation and regulations will also be amended so that, starting in the 2023 taxation year, the conversion rate applicable to the various amounts for calculating personal tax credits will be reduced from 15% to the new rate applicable to the first taxable income bracket of the personal income tax table, that is, 14%.

These amounts are:

- the basic amount;

- the amounts for persons living alone;

- the amount with respect to age;

- the amount for retirement income;

- the amount for a severe and prolonged impairment in mental or physical functions;

- the amount for children under 18 enrolled in vocational training or post-secondary studies;

- the amount for other dependants;

- the amounts for calculating the transferred amount representing the recognized parental contribution.

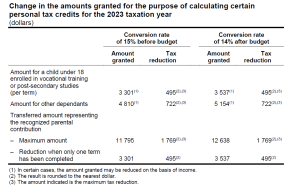

Increase in the amounts granted for the purpose of calculating certain personal tax credits

The tax legislation will be amended to include an increase in the amounts granted for the purpose of calculating certain personal tax credits as of the 2023 taxation year, which are shown in table 1 in the appendix.

Other non-refundable tax credits affected

Four other non-refundable tax credits are converted to a harmonized rate at the bottom tax rate such as:

- the tax credit for career extension;

- the first-time home buyers’ tax credit;

- the tax credit for volunteer firefighters;

- the tax credit for search and rescue volunteers.

As a result, their conversion rate also drops from 15% to 14% as of the 2023 taxation year.

Clarifications concerning the application of source deductions of income tax

Revenu Québec will publish new source deduction tables for Québec income tax for the various pay periods reflecting the general income tax reduction for the 2023 taxation year, but these new tables will only be applicable as of July 1, 2023.

Other amendments

The tax regulations will be amended to replace the rate of 15% for source deductions from the following payments by a rate of 14%:

- single payments under a registered retirement income fund or a registered retirement savings plan;

- payment under a government work-incentive project;

- assistance payment made under a registered disability savings plan;

- remuneration of self-employed fishers.

Other single payments

To bring the rates of source deduction in line with the upcoming changes to the tax table, the tax regulations will be amended to replace the rate of 15% for source deductions from single payments that do not exceed $5 000 by a rate of 14%. Where single payments exceed $5 000, the rate of source deduction of 20% will be replaced by a rate of 19%.

Bonus and retroactive increases

The tax regulations will be amended to provide that, where an employer pays, after June 30, 2023, a bonus or a retroactive increase to an employee whose estimated annual pay, including the bonus or retroactive increase, does not exceed the threshold determined for the year in accordance with the tax regulations, the rate of 8% for source deductions from such payments will be replaced by a rate of 7%.

Special tax applicable on accumulated investment income from a registered education savings plan

The special tax deduction rate of 8% in Québec on the accumulated investment income of a registered education savings plan (RESP) is maintained so that the combined (federal and Québec) tax rate of 20% continues to apply to Québec residents.

Consequential amendments

Presumption of residence

Currently, the tax legislation states that the child of an individual who is deemed to be resident in Québec because of his or her duties is also deemed to be resident in Québec, provided the child is the individual’s dependant and the child’s income for the year does not exceed a certain threshold.

For the purposes of this presumption, the limit on the child’s income for a taxation year subsequent to the 2022 taxation year will be established on the basis of $12 638, which will be automatically indexed each year as of January 1, 2024.

Refundable tax credit for childcare expenses

The definition of “eligible child” will be amended, as of the 2023 taxation year, to state that an eligible child of an individual for a taxation year means a child of the individual or the individual’s spouse, or a child who is a dependant of the individual or the individual’s spouse and whose income for the year does not exceed $12 638, if, in any case, at any time during the year, the child is under 16 years of age or is dependent on the individual or the individual’s spouse and has a mental or physical infirmity.

For greater clarity, the amount of $12 638 will be automatically indexed each year as of January 1, 2024.

Alternative minimum tax

The tax legislation will be amended to replace the rate of 15% by a rate of 14% as of the 2023 taxation year.

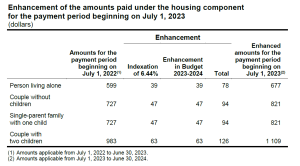

Enhancement of the housing component of the refundable solidarity tax credit

The indexation normally provided for in the housing component of the solidarity tax credit will be doubled and applied as of the next payment period, which begins on July 1, 2023.

Taking into account the indexation of the tax system, which has already been provided for, as of July 2023, taxpayers will obtain additional amounts of up to:

- $78 for a person living alone;

- $94 for a couple without children or a single-parent family with one child;

- $126 for a couple with two children.

Table 2 in the appendix shows the increase in the amounts of the housing component of the solidarity tax credit.

Enhancement of the non-refundable tax credits for volunteer firefighters and search and rescue volunteers

The non-refundable tax credit for volunteer firefighters and the non-refundable tax credit for search and rescue volunteers will be increased from $3 000 to $5 000 as of the 2023 taxation year.

The tax legislation will also be amended to provide that the $5 000 amount will be automatically indexed each year, as of the 2024 taxation year.

Measures pertaining to businesses

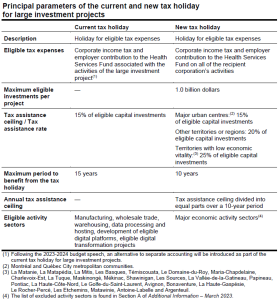

Introduction of a new tax holiday relating to the carrying out of a large investment project

The government has decided to introduce a new tax holiday, namely the new tax holiday relating to the carrying out of a large investment project (hereinafter “new tax holiday”).

A corporation that, after March 21, 2023, carries out a large investment project in Québec may, under certain conditions, benefit from an income tax holiday and from a holiday from the employer contribution to the Health Service Fund (HSF).

Similarly, a partnership that, after March 21, 2023 carries out a large investment project in Québec may, under certain conditions, benefit from a holiday from the employer contribution to the HSF. A corporation that is a member of the partnership may benefit from the tax holiday regarding the tax in respect of its share of income from the partnership.

This new tax holiday will have a 10-year duration. It will be calculated by applying a rate of 15%, 20% or 25% to the cumulative total eligible expenditures related to the project. This rate will be determined according to the economic vitality index of the territory where the large investment project will be carried out, subject to certain rules applicable in the event that a large investment project is carried out in more than one territory. In addition, the cumulative total eligible expenditures relating to the project may not exceed $1 billion.

To qualify for the new tax holiday, a project must not be carried out in an excluded sector of activity and, in order to claim it, the corporation or partnership must not carry on activities in an excluded sector of activity, subject to certain applicable rules.

In addition, the project will have to satisfy a requirement to meet the $100-million investment threshold before the expiration of a 48-month investment period, beginning on the date specified on the initial qualification certificate issued in respect of the project, as well as a requirement to maintain that threshold throughout the tax-free period applicable to the investment project.

The principal parameters of the current and new tax holiday for large investment projects are presented in table 3 of the appendix.

Application date

The new tax holiday will apply in respect of an investment project for which an application for an initial qualification certificate is made after March 21, 2023.

Elimination of the former tax holiday relating to the carrying out of a large investment project

The former tax holiday relating to the carrying out of a large investment project (hereinafter referred to as the “former TH-LIP”) will be eliminated as of March 21, 2023 and, as a result, no new application for the issuance of an initial qualification certificate will be accepted. However, the abolition of the former TH-LIP will not affect the eligibility of corporations and partnerships that already hold a qualification certificate or that have already applied for the issuance of an initial qualification certificate under the former TH-LIP.

Changes to the refundable tax credit for Québec film or television production

The Act respecting the sectoral parameters of certain fiscal measures will be amended to recognize the contribution of certain market intermediaries in the online distribution of certain productions and to ease the current rules to facilitate the acquisition of stock footage.

Application date

These changes will apply in respect of a film or television production for which an application for an advance ruling, or an application for a qualification certificate, is filed with the Société de développement des entreprises culturelles (SODEC) after March 21, 2023.

Enhancement of the refundable tax credit for book publishing

The government is providing the following enhancements to this tax credit:

- an increase in the cap on labour expenditures from 50% to 65% for preparatory and digital publishing costs;

- an increase in the rate of the tax credit from 27% to 35% for printing costs.

Application date

These amendments will apply in respect of an eligible work or an eligible group of works for which an application for an advance ruling, or an application for a qualification certificate, is filed with the SODEC after March 21, 2023.

Enhancement of the refundable tax credit for the production of multimedia events or environments presented outside Québec

The government is providing improvements to the tax credit for the production of events or multimedia environments staged outside Québec for the purpose of:

- expanding the scope of the definition of qualified labour so it applies to all services rendered in Québec, as part of an eligible project, as is the case with other cultural tax credits;

- increasing the cap on labour expenditures from 50% to 60% to take into account the increase in labour costs in the industry.

Application date

These changes will apply in respect of a qualified production for which an application for an advance ruling, or an application for a qualification certificate, is filed with the SODEC after March 21, 2023.

Measures pertaining to commodity taxes

Increase in the specific duty on new tires for road vehicles

Starting July 1, 2023, the duty on new tires for cars will be $4.50, while the duty for truck tires will be $6.

Implementation of the new program for managing the tax exemption of First Nations regarding taxes

The government plans to gradually deploy an automated system that will enable First Nations people with Indian status to benefit from the exemption to which they are entitled directly at the time of purchase.

Other measures

Reduction in QPP contributions for workers aged 65 or older

The government is announcing changes to be made to the Québec Pension Plan (QPP) that will come into effect on January 1, 2024 to encourage job retention for workers aged 65 or over, namely:

- the option to discontinue contributions to the QPP for people aged 65 or over who are receiving a retirement pension;

- the introduction of pension protection for workers aged 65 or over earning less than their career average earnings.

Introduction of an option to stop paying QPP contributions for workers aged 65 years or older

The Act respecting the Québec Pension Plan will be amended to introduce, as of January 1, 2024, an option allowing workers aged 65 or over to stop paying QPP contributions, provided they are also receiving a QPP or Canada Pension Plan (CPP) retirement pension.

Clarifications and terms and conditions applicable to employees

Provided they are receiving a QPP or CPP retirement pension, employees may elect to stop paying QPP contributions as of the day following their 65th birthday by filing a form with the employer. This form must be kept by the employer and must be filed with Revenu Québec upon request.

The election will take effect on the first day of the month following the date on which the election form is given to the employer. Therefore, an employer will be able to stop deducting QPP contributions as of the first pay of the month following the month in which the election form is provided.

Once made, the election to stop making QPP contributions by a worker who is an employee will also apply to his employer, so that the latter will also become exempt from making QPP contributions as of the same date as that which applies to the employee.

If a worker changes jobs, a new election must be made with the new employer.

Clarifications and terms and conditions applicable to self-employed workers and workers responsible for an FTR or an IR

Self-employed workers and workers responsible for a family-type resource (FTR) or an intermediate resource (IR) may elect to stop contributing to the QPP when they file their income tax return for the year in which they reach age 65, provided that they were receiving a QPP or CPP retirement pension at that time.

Workers will make this election by indicating on a form to be filed with Revenu Québec the month of the year in which they decide that the election will take effect. The election indicated by the worker on the form cannot be earlier than the first day of the month following the one in which the worker reaches age 65 and was also receiving a QPP or CPP retirement pension.

Additional clarifications and terms and conditions

The election to stop paying QPP contributions will be revocable. An election to stop contributing to the QPP will remain in effect until the day on which its revocation takes effect or until December 31 of the year in which the worker will reach the age of 72.

Similarly, a revocation of an election to stop paying QPP contributions will remain in effect until the day of the month in which a new election to stop paying QPP contributions made to an employer becomes effective.

Lastly, the forms for making an election to stop paying QPP contributions will include a statement by workers acknowledging that, as a result of the election, no future supplement to the retirement pension can be allocated or counted in respect of the employment covered by the election.

Introduction of pension protection for workers aged 65 or older

The government plans to change the method of calculating the QPP’s base plan as of January 1, 2024, to ensure that years where earnings were low starting at age 65 do not reduce the average earnings that are used to calculate the retirement pension.

End of the obligation to contribute to the QPP for workers over 72 years of age

The Act respecting the Québec Pension Plan will be amended so that, as of the year 2024, the obligation to contribute to the QPP will cease for workers over 72 years of age, for all workers subject to the contributions provided for by this Act.

The obligation to contribute to the QPP for a worker will cease as of the year in which the worker turns 73. Consequently, all wages paid and earnings received as of January 1 of the year in which a worker reaches age 73 will no longer be subject to QPP contributions.

Strengthening tax compliance regarding cryptoassets

Amendments will therefore be made to the tax legislation and regulations to give the Minister of Revenue the power to ask taxpayers whether they own or have used virtual assets to carry out certain transactions during a taxation year or a fiscal year, as the case may be, and to request, where applicable, the details of these transactions.

Application date

This measure will apply as of the date of assent to the bill giving effect to this measure.

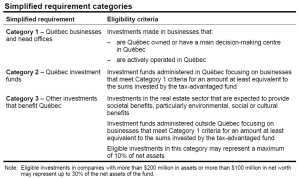

Changes to the intervention framework for tax-advantaged funds

Québec has three tax-advantaged funds: the Fonds de solidarité FTQ, Fondaction and Capital régional et coopératif Desjardins (CRCD). The government is announcing initiatives aimed at:

- modernizing the intervention framework of tax-advantaged funds;

- strengthening their savings role and refocusing tax assistance related to the acquisition of shares of these funds on Quebecers most in need of incentives to save.

In order for the tax-advantaged funds to better meet the current needs of Québec businesses and savers, their intervention framework will be amended in order to:

- update their role through renewed investment functions;

- increase their impact in Québec via a simplified investment requirement;

- maximize the economic impact of their investments.

Reorganization of investment categories for the three tax-advantaged funds

The government is announcing a new simplified investment requirement with three investment categories that will be implemented as of 2024 (see table 4 in the appendix).

The investment requirement that eligible investments must represent at least 65% of the funds’ net assets will be maintained.

The rollout of investments that are eligible under the requirement will be governed by an investment policy approved by the Minister of Finance.

Update on the function of each of the three tax-advantaged funds

In response to Québec’s economic challenges, the functions of the tax-advantaged funds will be updated.

Increase in the minimum holding period for a labour-sponsored fund share

The government is gradually extending the minimum holding period for Fonds de solidarité FTQ and Fondaction shares from two to five years.

Accordingly, the minimum holding period for shares of a labour-sponsored fund will be increased to three years for shares acquired as of June 1, 2024, to four years for shares acquired as of June 1, 2025 and to five years for shares acquired as of June 1, 2026. This change will take full effect on June 1, 2026.

Introduction of a rule limiting access to the non-refundable tax credit for a labour-sponsored fund

The tax legislation will be amended so that high-income individuals will no longer be eligible for the non-refundable tax credit.

In particular, an individual will no longer be able to benefit from this tax credit, for a taxation year, as long as the individual’s taxable income is subject to the highest tax rate of the personal income tax table for the base year. For greater clarity, it will not be possible to carry forward the unallocated amount of the non-refundable tax credit.

The base taxation year will mean the taxation year that ends on December 31 of the second calendar year preceding the taxation year for which an individual claims the non-refundable tax credit for a labour-sponsored fund.

This change will apply to a claim for the non-refundable tax credit for a taxation year after the 2023 taxation year in respect of shares acquired after December 31, 2023.

Consequently, for the 2024 taxation year, the first year of application of this new measure, the base year will be the 2022 taxation year. The maximum taxable income not subject to the highest tax rate in the applicable personal income tax table for that base tax year was $112 655. Therefore, only individuals whose taxable income for the 2022 taxation year did not exceed the $112 655 threshold will have access to the tax credit for a labour-sponsored fund for the 2024 taxation year.

Appendix

Table 1

Table 2

Table 3

Table 4

Notice to Users

The reproduction of the contents of this Québec budget summary is authorized without restriction.

This budget summary is based on the documents issued by the Québec government. The legislation, when enacted, may vary from the summary described herein. Professional advice should be obtained.

PSB Boisjoli LLP has acted solely as publisher of this budget summary. Consequently, neither PSB BOISJOLI LLP nor any person involved in its preparation accepts any liability for its contents or for any consequences arising from its use.