Introduction

On March 22, 2022, the Minister of Finance, Mr. Eric Girard, tabled his 2022-2023 budget plan which was prepared under very special circumstances and which represents the government’s fourth budget. This budget provides tax measures to cope with the rising cost of living, to stimulate economic growth and continue efforts relating to the environment.

Here are the highlights of the 2022-2023 budget.

Measures pertaining to individuals

Introduction of the refundable tax credit granting a one-time amount to mitigate the increase in the cost of living

Additional tax assistance, called the “refundable tax credit granting a one-time amount to mitigate the increase in the cost of living” will be granted in a single instalment.

Determination of the refundable tax credit granting a one-time amount to mitigate the increase in the cost of living

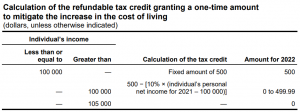

An eligible individual will be entitled, in the 2022 calendar year, to the payment of an amount of up to $500 in respect of a refundable tax credit granting a one-time amount to mitigate the increase in the cost of living.

This amount will be reduced where an individual’s net income is in excess of $100 000 for the 2021 calendar year.

Eligible individual

An eligible individual means an individual who, at the end of December 31, 2021, met the following conditions:

- the individual was at least 18 years old, or an emancipated minor, or a minor who is the father or mother of a child with whom he or she resides;

- the individual was residing in Québec;

- the individual had one of the following statuses:

- a Canadian citizen,

- a permanent resident,

- a temporary resident,

- a protected person within the meaning of the Immigration and Refugee Protection Act;

- the individual was not an excluded individual.

Excluded individual

An excluded individual means one of the following individuals:

- a person who is exempt from tax under any of sections 982 and 983 of the Taxation Act or any of subparagraphs a to d and f of the first paragraph of section 96 of the Tax Administration Act for the 2021 calendar year;

- at the end of the 2021 calendar year, a person who is detained in a prison or similar institution and who has been so detained throughout one or more periods, totalling more than 183 days, included in that year.

Amount paid

The amount of the one-time tax assistance paid under the refundable tax credit granting a one-time amount to mitigate the increase in the cost of living will be $500 when the individual’s personal net income, for the 2021 calendar year, does not exceed $100 000.

Where the individual’s personal net income for the 2021 calendar year exceeds $100 000, but does not exceed $105 000, the one-time $500 amount will be reduced based on a 10% rate applicable to the amount by which the individual’s personal net income for the 2021 calendar year exceeds $100 000.

The table below illustrates the calculation of the one-time amount to mitigate the increase in the cost of living.

Payment of the refundable tax credit

An individual who is eligible for the refundable tax credit granting a one-time amount to mitigate the increase in the cost of living will receive the amount of the one-time tax assistance without having to apply for it, provided that the individual has filed his or her income tax return for the 2021 calendar year with Revenu Québec.

Therefore, as of March 23, 2022, Revenu Québec will process income tax returns for the 2021 calendar year by adding the refundable tax credit.

Where, on March 22, 2022, the notice of assessment for the 2021 calendar year has already been issued to an individual by Revenu Québec, a new notice of assessment for the 2021 calendar year will be sent to the individual to include the refundable tax credit.

Application of allocation and compensation rules

Under the Tax Administration Act (hereinafter referred to as the “TAA”), where an individual entitled to a refund by reason of the application of a fiscal law is also a debtor under such a law or about to become so, the Minister of Revenue may apply such refund to the payment of the debt of that person, up to the amount of such debt, and give him notice of it.

For the application of this tax credit, the allocation and compensation rules will apply accordingly.

Perpetuation of the tax credit for a major cultural gift

This tax credit, of up to $6 250, is available to individuals, under certain conditions, in relation to a donation made to an eligible cultural donee before January 1, 2023.

An individual, other than a trust, may claim, for a taxation year, in addition to the tax credit for gifts, a non-refundable tax credit corresponding to 25% of the eligible amount of a gift of money of at least $5 000, and of up to $25 000, made by the individual or the individual’s succession to an eligible cultural donee. However, an individual may claim this tax credit for only one major cultural gift.

The tax legislation will be amended to remove the deadline for making a donation so that it can be recognized as a major cultural gift, thereby making this tax credit permanent.

Extension of the refundable tax credit for the upgrading of residential waste water treatment systems

With a maximum value of $5 500 per eligible dwelling, the financial assistance provided by this refundable tax credit corresponds to 20% of the portion of eligible expenses, exceeding $2 500, that an individual has paid under a service agreement entered into before April 1, 2022, to have recognized work carried out to upgrade the waste water treatment systems of the individual’s principal residence or cottage suitable for year-round occupancy.

Extension of the eligibility period

The period during which a service agreement may be entered into with a qualified contractor, for the application of this tax credit will be extended by five years, that is, until March 31, 2027.

The extension will benefit individuals who have such work carried out by a qualified contractor under a service agreement entered into after March 31, 2022 and before April 1, 2027.

Determination of the tax credit

An individual, other than a trust, who is a resident in Québec at the end of December 31 of a particular taxation year preceding the 2028 taxation year, but after the 2022 taxation year, may claim, for that year, a refundable tax credit for recognized work in relation to a particular eligible dwelling owned by the individual, in an amount equal to the lesser of the following amounts:

- the amount obtained by multiplying 20% by the amount by which the individual’s eligible expenditures for that particular year, in relation to an eligible dwelling of the individual, exceeds the amount by which $2 500 exceeds the aggregate of all amounts each of which is the individual’s eligible expenditure, in relation to the eligible dwelling, for any taxation year after the year 2016 and before the particular year;

- the amount by which $5 500 exceeds the aggregate of all amounts each of which is an amount that the individual, or a person with whom the individual owns the eligible dwelling, is deemed to have paid to the Minister in relation to the tax credit for any taxation year preceding the particular year.

The other terms and conditions for this credit will remain unchanged.

Measures pertaining to businesses

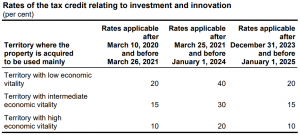

Extension of the temporary increase in the tax credit relating to investment and innovation

The tax credit relating to investment and innovation is granted to a qualified corporation that acquires, after March 10, 2020, and before January 1, 2025, manufacturing or processing equipment, general-purpose electronic data processing equipment or certain management software packages.

On March 25, 2021, it was announced that the tax credit rates would be temporarily doubled to encourage Québec businesses to carry out their investment projects and to accelerate Québec’s economic recovery. It was then planned that this temporary increase would end on December 31, 2022.

The temporary increase in the tax credit relating to investment and innovation will be extended by one year, that is, until December 31, 2023.

The table below sets out the rates of the tax credit that will be applicable following the extension based on the territory where the specified property is acquired to be used mainly and the date on which the specified expenses are incurred.

Application date

The temporary increase of the tax credit rates will apply in respect of specified expenses incurred after March 25, 2021 and before January 1, 2024, for the acquisition of a specified property after March 25, 2021 and before January 1, 2024, or for the acquisition of a specified property after March 25, 2021 and before April 1, 2024, where:

- the property will have been acquired in accordance with a written obligation contracted before January 1, 2024; or

- the construction of the property by or on behalf of the corporation or partnership has started before January 1, 2024.

As initially announced, however, this temporary increase does not apply to a property:

- acquired in accordance with a written obligation contracted on or before March 25, 2021;

- the construction of which by or on behalf of the corporation or partnership had started on March 25, 2021.

Introduction of the refundable tax credit for the production of biofuel in Québec

To achieve its greenhouse gas (GHG) emission reduction objectives, the refundable tax credit for the production of ethanol in Québec, the refundable tax credit for cellulosic ethanol production in Québec, and the refundable tax credit for the production of biodiesel fuel in Québec have been announced over the last years. However, these tax credits will expire on March 31, 2023.

The government has agreed to review its approach to tax assistance for biofuel production. Accordingly, the tax legislation will be amended to include the refundable tax credit for the production of biofuel in Québec.

A qualified corporation will be able to claim this tax credit in respect of eligible biofuels that it produces in Québec for sale and use in Québec, up to a maximum of 300 million litres per year. The tax credit will be available from April 1, 2023 to March 31, 2033.

It will be granted for the production of biofuels eligible for tax assistance under the current terms of the Québec tax system, that is, ethanol, cellulosic ethanol and biodiesel fuel, as well as for the production of other low-carbon-intensity fuels produced from eligible materials such as organic matter, except for biofuels used to power aircraft, boats, or ships.

The rate of the tax credit will be determined according to various factors so that the level of tax assistance applicable to an eligible biofuel produced by a qualified corporation will increase

according to the decrease in carbon intensity observed for that biofuel compared to the gasoline or diesel fuel that it replaces.

Also, given the introduction of this new tax credit, the tax credits currently provided for in the Québec tax system will not be renewed.

Qualified corporation

A qualified corporation means, for a taxation year, a corporation, other than an excluded corporation[1] for the year, that, in the year, has an establishment in Québec where it carries on a business engaged in the production of biofuel and that holds a qualification certificate issued by the Minister of Energy and Natural Resources for that year or a preceding taxation year, in respect of a biofuel included in its eligible production of biofuel for a particular month in the taxation year.

Eligible biofuel

The term “eligible biofuel” will refer to a low-carbon-intensity fuel that is a liquid fuel under standard conditions, is produced from eligible materials, can be blended with gasoline or diesel fuel and for which the Minister of Energy and Natural Resources has issued a qualification certificate to the corporation that produces it for the taxation year in which it was produced.

Date of application

A qualified corporation may claim the refundable tax credit for a taxation year ending after March 31, 2023.

This tax credit will be granted for a temporary period beginning no sooner than April 1, 2023 and ending no later than March 31, 2033

Extension of and changes to the refundable tax credit for the production of pyrolysis oil in Québec

The refundable tax credit for the production of pyrolysis oil in Québec was introduced as part of the March 27, 2018 budget. This refundable tax credit is granted to a qualified corporation in respect of eligible pyrolysis oil it produces in Québec from residual forest biomass, which is sold in and intended for Québec, up to 100 million litres per year. However, the eligibility period for this tax credit ends on March 31, 2023.

The refundable tax credit for the production of pyrolysis oil in Québec will be extended for a period of ten years, that is, until March 31, 2033.

Changes will also be made to the tax credit, particularly with respect to the tax credit rate, so that the level of assistance granted to a qualified corporation, with respect to its eligible production of pyrolysis oil, will take into account the reduction in carbon intensity induced by this biofuel, compared to the fuel it replaces, over its life cycle.

In addition, the maximum number of litres for which a qualified corporation may benefit from the tax credit will be increased to 300 million litres per year.

Application date

The amendments to this tax credit will apply for a taxation year that ends after March 31, 2023.

Other measures

Amendment to the rules governing the interruption of the prescription period

Under the TAA, the recovery of an amount owed under a fiscal law is prescribed by 10 years after the day on which the notice of assessment was sent or, in the case of charges or fees, from the time the charges or fees are applied.

The 10-year prescription period for Québec tax claims may be extended by “suspension” or “interruption”.

When the prescription period is “interrupted,” the prescription period has the effect of resetting the counter to zero and thus lengthening the period during which the Minister of Revenue is legally entitled to collect its tax claim against the debtor.

The 10-year prescription period provided for in the TAA is interrupted when the Minister of Revenue takes certain measures, including applying a tax refund to the payment of a taxpayer’s debt, up to the amount of that debt, and gives notice to the taxpayer.

Consequently, the TAA will be amended to remove compensation as a reason for interrupting the prescription period when a taxpayer entitled to a refund under a fiscal law is also a debtor under such a law or is about to be, and the Minister of Revenue applies the refund to pay the tax debt of that taxpayer.

Application date

This measure will apply to allocations of refunds made on or after a date to be determined by the government after the bill giving effect to this measure is assented to.

Renewing the elimination of interest on student loans for 2022-2023

The government is announcing that it will continue to pay the interest on student loans payable between April 1, 2022 and March 31, 2023.

Consequently, the government will, on behalf of borrowers, pay the interest owing to financial institutions and set an interest rate of 0% on amounts owing to the Minister of Higher Education for the duration of the measure.

A waiver of interest payment or an interest rate of 0% should therefore, depending on the case, be applied to all files in collection for the period from April 1, 2022 to March 31, 2023.

Extension of the Roulez vert program

The Roulez vert program provides rebates for the purchase of several types of electric vehicles, as well as for the purchase and installation of charging stations at home, at work and in multi-unit buildings.

The government is announcing that the maximum rebate granted for the acquisition of electric vehicles under the Roulez vert program will be, as of April 1, 2022:

- $7 000 for new fully electric vehicles;

- $5 000 for new plug-in hybrid vehicles;

- $3 500 for used fully electric vehicles.

For the period after fiscal year 2022-2023, details on the parameters of the electric vehicle rebates will be announced at a later date.

Simplification of administrative steps following a death

The government plans to implement a government action plan to simplify administrative steps following a death, with a view to:

- speeding up the registration of a death in the register of civil status with the implementation of an electronic platform for registering deaths;

- facilitating the appointment of the liquidator of an estate by reinforcing the obligation to register the liquidator in the register of personal and movable real rights;

- improving the administration of files, particularly by increasing collaboration between government departments and bodies in order to speed up the processing of files and by simplifying the rules governing the liquidation of an estate

Notice to Users

The reproduction of the contents of this Québec budget summary is authorized by the Ordre des comptables professionnels agréés du Québec without restriction.

This budget summary is based on the documents issued by the Québec government. The legislation, when enacted, may vary from the summary described herein. Professional advice should be obtained.

PSB BOISJOLI LLP acted solely as publisher of this budget. Consequently, neither PSB BOISJOLI LLP nor any person involved in its preparation accepts any liability for its contents or for any consequences arising from its use.

[1] An excluded corporation means a corporation that is exempt from tax for the year, a Crown corporation or a wholly controlled subsidiary of such a corporation.